Post-trade Processing

Optimize operational efficiency with a high degree of automation and smart governance

In a world of shrinking margins and growing complexity of exotics transaction processing, it is fundamental that the back-office function provides reliability, efficiency, auditability and high degree of governance and controls. To reduce operational costs while complying with an ever-changing regulatory landscape, firms must transform the back office into an agile, adaptable, scalable and intelligent processing machine that can serve business needs efficiently.

- A cross-asset, rules based and data-driven approach

- Straight-through processing (STP) with highly configurable workflows

- Digitalization of back office to offer firms the ability to achieve global transformational intiatives and adopt new paradigms such as cloud, blockchain, and AI

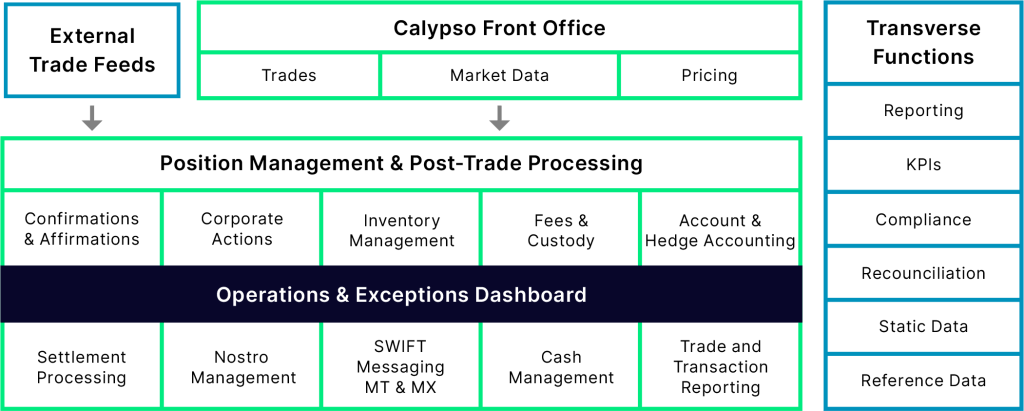

Our post-trade processing solution

Our platform’s native front-to-back integration provides you with the ability to analyze and adapt your processes to achieve optimal STP and reduce total cost of ownership. In addition, the solution’s Task Station consolidates all exceptions arising from workflow-based STP and provides you with a unique real-time cross functional dashboard that monitors the daily activity of all users.

Key Features:

- Ready-to-use operating model with configurable workflows

- Comprehensive connectivity with other business functions and platforms

- Consolidated trading infrastructure on a single technology stack

- Real-time trade events capture

- Seamless data flow from the front office to the middle and back offices

Confirmation & Matching

Our STP electronic and automated trade-to-confirmation solution provides a framework for real-time matching and settlement of any message type and delivers essential audit, investigation, and allege functions.

Key features:

- Supports paper (e.g., HTML, PDF) or electronic (e.g., SWIFT, XML) messages

- Matches external messages in real time – in paper or electronic formats

- Beyond matching, includes investigation, chasing, aliasing, and allege functionalities

- Embeds a secure authorization mode and the 4-eyes principle

- Covers bilateral and unilateral confirmations

- Offers digital signatures and side-by-side matching result

Multi-jurisdictional Settlements

Market standards around settlements are evolving. As the SWIFT MT to MX format change is being rolled out by many jurisdictions, our evolutive platform provides you with real-time settlement, message formats, workflows, and exceptions monitoring.

XVA metrics:•Risk–neutral and real–world calibration models•LMMandHull & Whitediffusion models•Marginal and pre–trade incremental XVA•Post–trade XVA optimization•XVA sensitivities for Basel III’sFRTB SA–CVA•XVA explainedKey features:

- Generates advice and actual payments in any format including SWIFT MT and MX

- Supports local jurisdiction adoptions

- Automatically assigns settlement and delivery instructions and prepares payments in real time

- Leverages the integrated Calypso workflow and STP process

- Creates exception rules and triggers manual validation in real time enabling quick reaction to market crisis or instability

Fully consistent with our front-office pricing engineand collateral functionality•One set of CSAs and legal agreements shared with back office (BO)and collateral functions•Performance accelerated by mathematical optimizationFully consistent with our front–office pricing engineand collateral functionality•One set of CSAs and legal agreements shared with back office (BO)and collateral functions•Performance accelerated by mathematical optimization

Cash Management

Effective cash management starts with a clear understanding of current and future cash flows. Our centralized and highly automated cash management platform enables you to proactively manage default payments, cash positions, and offer complete client services.

Key features:

- Provides account maintenance and statements for self and client business

- Enables review and authorization of cash requirements and automatically generated funding trades

- Generates cash movements including principal exchanges, interest, management fees, upfront fees, termination fees, and collateral

- Monitors payment default

- Automates the cash sweeping process

Securities Processing

Securities post-trade processing is evolving fast. As trading volumes increase, firms are facing increased regulatory supervision and new regulated collateral movements, in the context of clearing and Uncleared Margin rules. Our integrated and STP solution offers support for all securities trading types and financing activities.

Key features:

- Provides comprehensive back-office processing including comparison, netting, settlement, profitability, corporate actions, accounting, and reporting

- Delivers full STP with exception-based user interaction

- Generates a parameter-based security master for global, complete coverage

- Processes trade updates and cancellations automatically

- Provides comprehensive audit trails

Accounting & Hedge Accounting

In the context of market volatility and regulatory scrutiny, financial institutions need to maintain parallel ledgers for their legal entities and require a complete solution for hedge accounting.

Our accounting module generates postings from transactions, settlements, margin call trades and more. Our hedge accounting modules provides financial instrument adjustment values across product types, asset classes, and derivatives.Key features:

- Generates real-time postings in multiple currencies

- Delivers end-of-day valuation and sub-ledgers

- Supports market-standard hedge accounting types: fair value, cash flow, and net investment

- Supports market-standard hedge risks: interest rate, FX,….

- Provides a dedicated solution for portfolio strategies (e.g., macro hedge) for interest rate risks (cash flow and fair value)

- Produces accounting P&L including line-per-line reclassifications

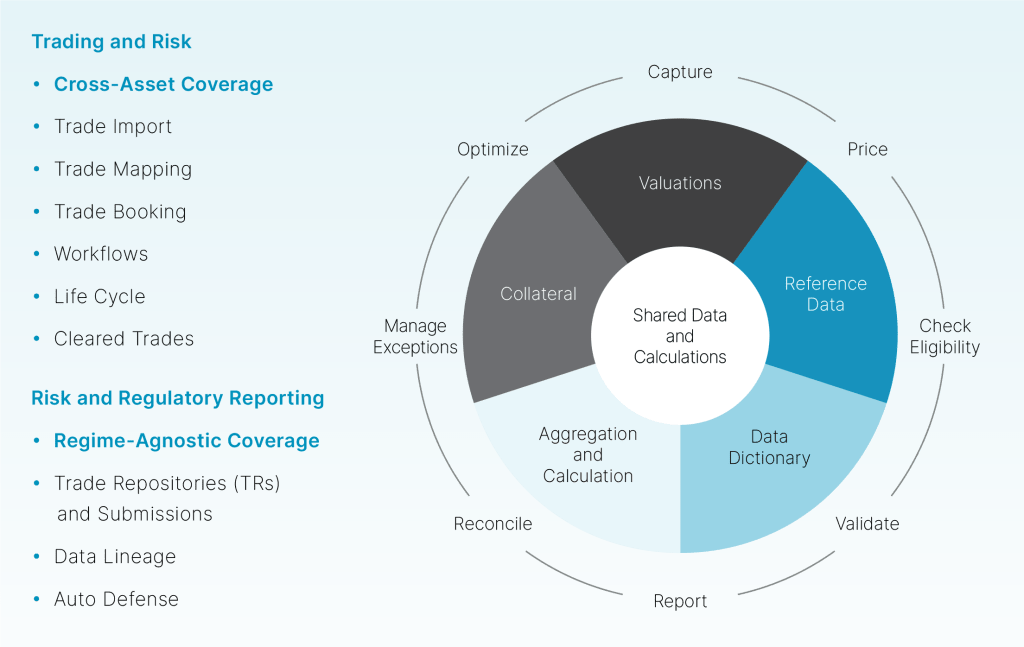

Regulatory Reporting

Current Regime and TR Coverage

- ASIC – DTCC

- Canada – DTCC

- DFA-CFTC – DTCC, CME SDR

- EMIR – DTCC

- FCA – DTCC

- FinfraG – REGIS TR

- HKMA – DTCC

- JFSA – DTCC Coverage Planned

- MAS – DTCC

- MiFIR APA – TRADEcho

- MiFIR ARM – Trax

- REMIT – Trayport

- SFTR – DTCC, IHS Markit, REGIS TR

Benefits for You

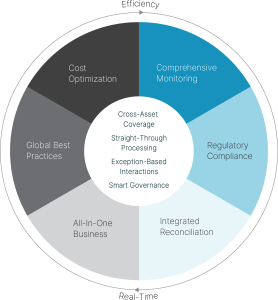

Cross-asset, cross-function integration

Our workflow-based and event-driven processes seamlessly merge your key business functions from front to back on a single platform that enables tight integration across your risk management, control, and processing functions.

Comprehensive cross-asset coverage

We offer robust back-office functionality that supports a full set of global post-trade processing functions and related core activities across all asset classes, offering consistent treatment of all traded instruments and enabling critical changes such as the LIBOR transition.

Confident compliance

To meet your regulatory reporting and internal compliance objectives, we provide a dedicated dashboard to track your submissions, comprehensive auditability, control, and regulatory reporting for cleared and uncleared trades, as well as ISDA 2021 conventions.

STP automation

With high automation at its core, our solution delivers the best STP rates of the market so your teams can focus on managing exceptions supported by AI and with the ease of user-configurable workflows and reports.

Birds-eye view

Using our real-time post-trade operations dashboard - Task Station, you can visualize and monitor the entire processing organization and easily drill down to view individual processes.

Greater speed, visibility, and accuracy

Our solution’s transparent key performance metrics enable you to easily access and convey valuable information quickly and efficiently across your organization and further improve your automation rates. We offer same-day settlement via CLSNow and others.

"TCS is delighted to be an Certified Implementation Partner for Nasdaq Calypso & Nasdaq AxiomSL. We look forward to combining our deep domain knowledge of the capital markets and advisory-led approach with Nasdaq’s industry-leading capabilities and solutions to provide top-notch service to our clients."

"To be appointed as an Certified Implementation Partner for Nasdaq Calypso & Nasdaq AxiomSL is a testimony to our more than eight years of collaboration. This will spur our company to break new ground, implementing the Calypso Treasury solution beyond Africa."

"Quinnox is thrilled to be an Certified Implementation Partner for Nasdaq Calypso & Nasdaq AxiomSL. Our long-standing collaboration focuses on delivering top-notch solutions for financial institutions, emphasizing value, and fostering sustainable growth. With almost two decades of partnership, we're eager to continue our journey of innovation and transformation with Nasdaq."

"To be an Certified Implementation Partner for Nasdaq Calypso & Nasdaq AxiomSL is to embody a commitment to exceptional expertise, unwavering dedication to client success, and a profound understanding of cutting-edge solutions. It's about providing seamless, tailored implementations that empower businesses to thrive in an ever-evolving digital landscape in the financial sector. It also signifies Exadel’s dedication to delivering excellence and equipping organizations with the full potential of Nasdaq's advanced solutions."

"We've been Nasdaq partners since 2012 and look forward to the next chapter of this journey. The recognition as a trusted Certified Implementation Partner program means a lot to us. We are committed to delivering to the highest standards for Nasdaq Calypso and AxiomSL product lines."

"It was an informative and compact training program. Ram covered all the areas of the course brilliantly. Also had the opportunity to discuss queries on the go, those were answered promptly.

All the topics were just great, I found it all right. I am sure the practice sessions in training would help the team put them to use in future projects"